- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

IME - Predicting Customer Delinquency for a Bank Using AutoML

Name: Mohamed AbdElAziz Khamis Omar

Title: Head of Data Science

Country: Egypt

Organization: IME

IME is a key market player in Data Management solutions. To learn more: www.infme.com

Awards Categories:

- Data Science for Good

- Moonshot Pioneer(s)

Business Challenge:

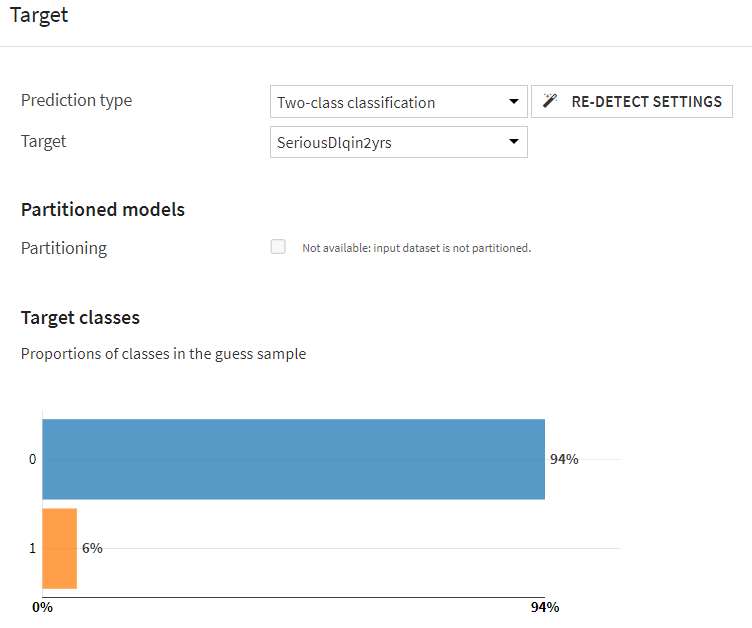

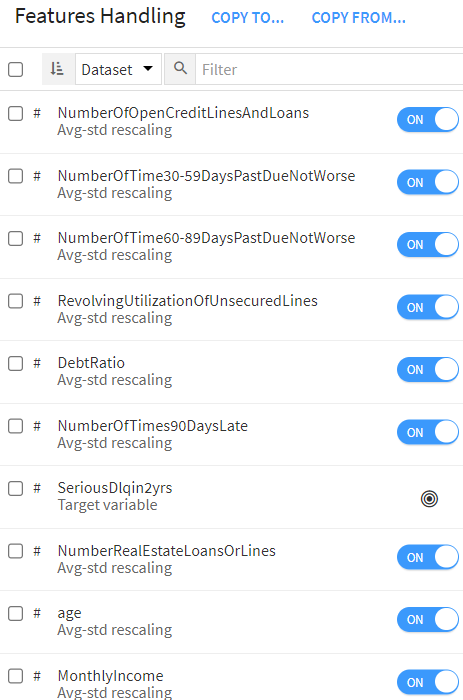

Our challenge was to predict customer delinquency for a bank. Due to the bank's data privacy, we trained the model on a public data set.

Original description from Kaggle: "The bank wants to decide who can get finance and on what terms. This can make or break investment decisions. For markets and society to function, individuals and companies need access to credit. Credit scoring algorithms, which make a guess at the probability of default, are the methods banks use to determine whether or not a loan should be granted.

This use case aims at improving the state of the art in credit scoring, by predicting the probability that somebody will experience financial distress in the next two years. The goal of this use case is to build a model that borrowers can use to help make the best financial decisions."

Business Solution:

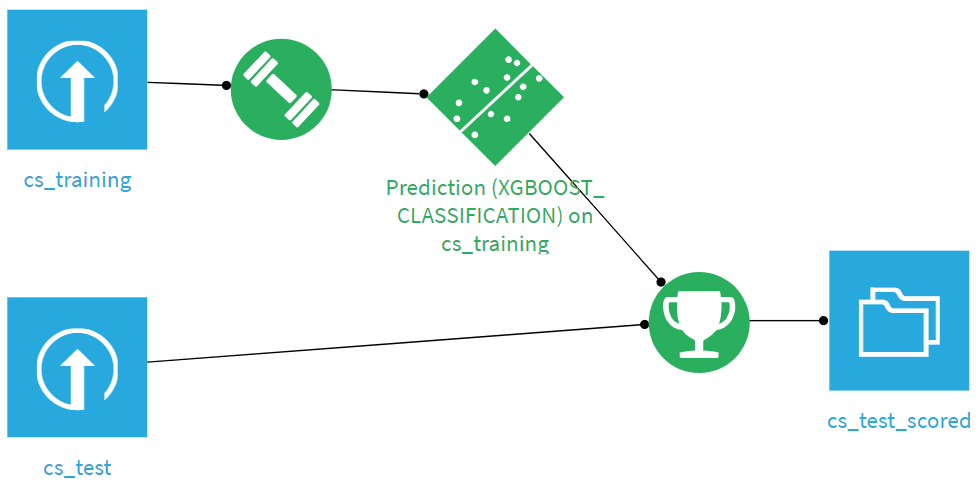

Using Dataiku AutoML.

Business Area: Accounting/Finance

Use Case Stage: Proof of Concept

Value Generated:

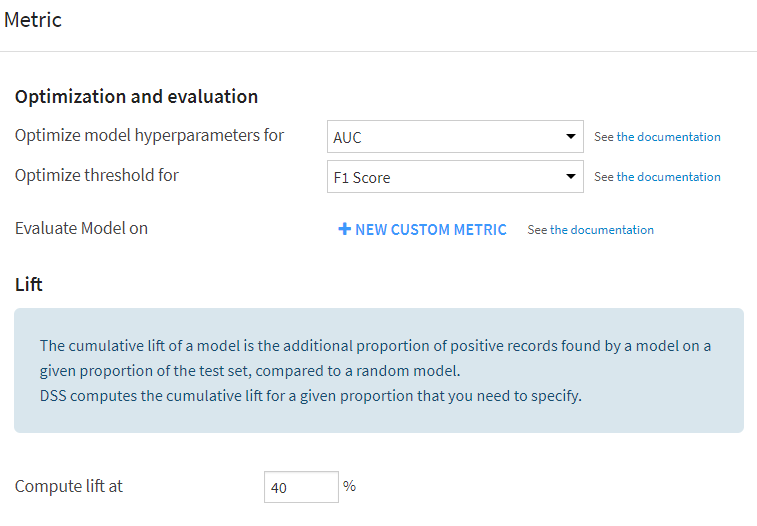

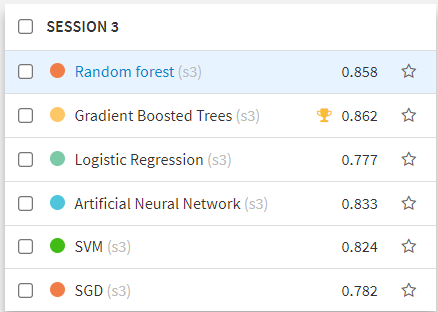

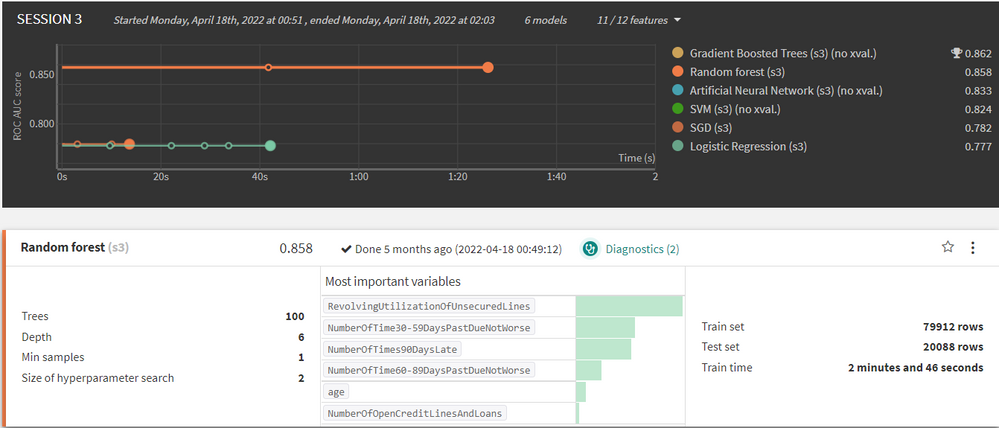

Improving the state of the art in credit scoring, by predicting the probability that somebody will experience financial distress in the next two years: AUC ROC = 0.862.

Value Brought by Dataiku:

Built-in Analysis and AutoML tools.

Value Type:

- Reduce cost

- Reduce risk

- Save time